The Tier Two Pension Scheme is a work-based, established under a trust which provides benefits based on defined contribution formula in the form of a lump sum.

Payable on retirement or death, or in respect of persons specified under the 2nd Tier Scheme covered under section 101 of the National Pension Act, 2008 (Act 766) as amended.

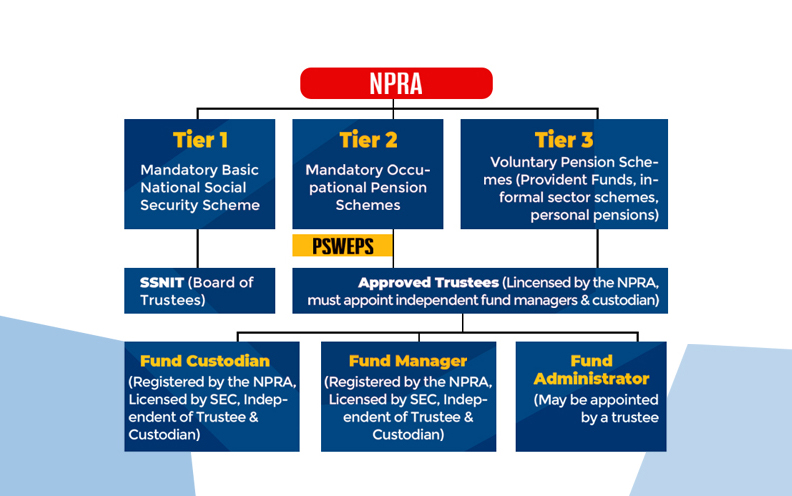

* It is a five percent mandatory deduction of the basic salary to the Scheme, PSWEPS, on behalf of the worker.

* The contribution shall be remitted by the employer within fourteen days from the end of each month.

* Where an employer deducts contributions from a worker’s salary, the employer shall hold the contributions in trust until remitted to the trustees of the Scheme.

* The Scheme pays a lump sum benefit to the contributor (beneficiary) on retirement, death, or in the event that a contributor is medically declared to be invalid.

* Total benefit received is made up of total paid-up monthly contributions, plus investment returns, less administrative charges.